cap and trade vs carbon tax canada

Carbon Tax vs. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

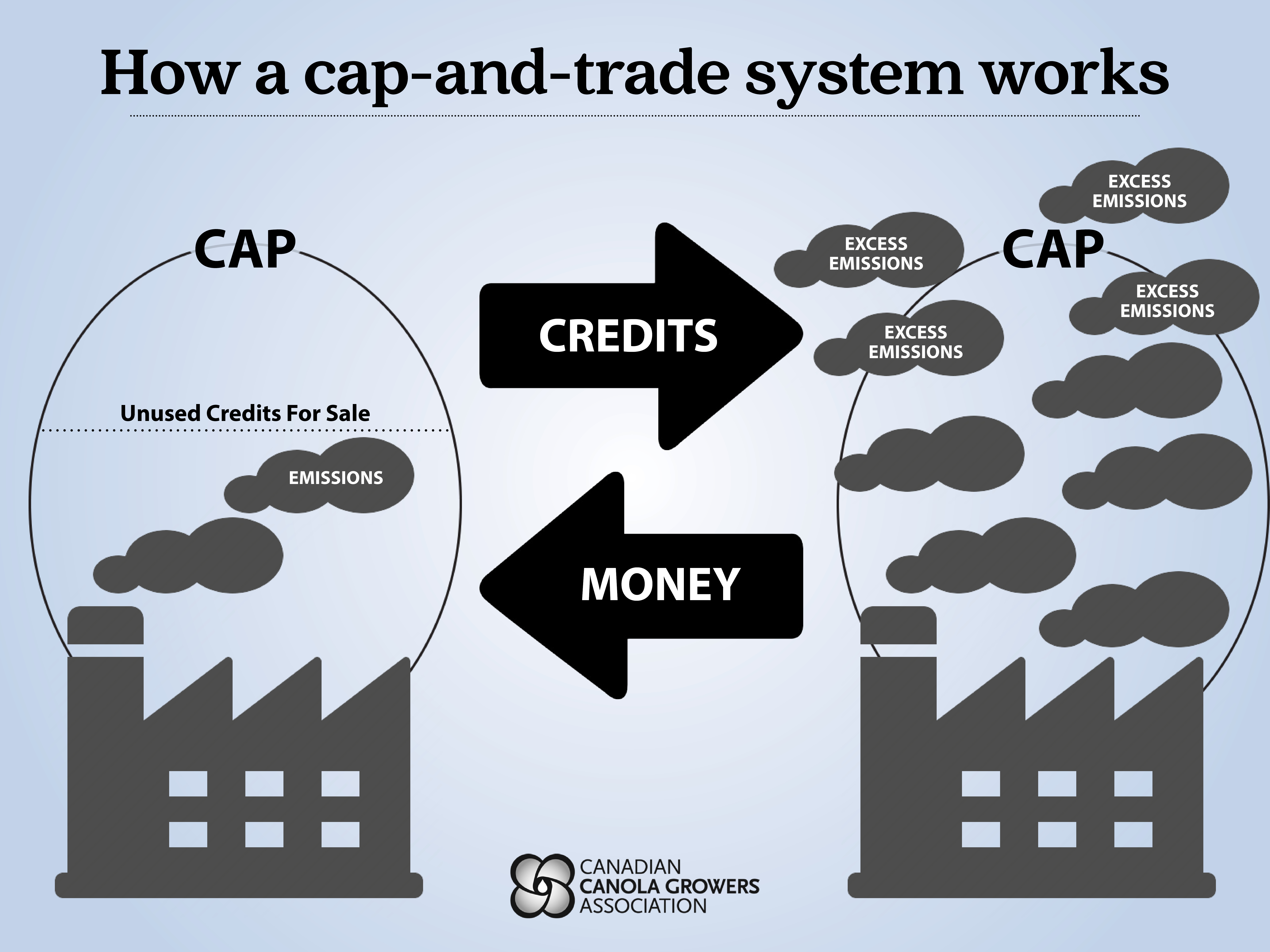

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a.

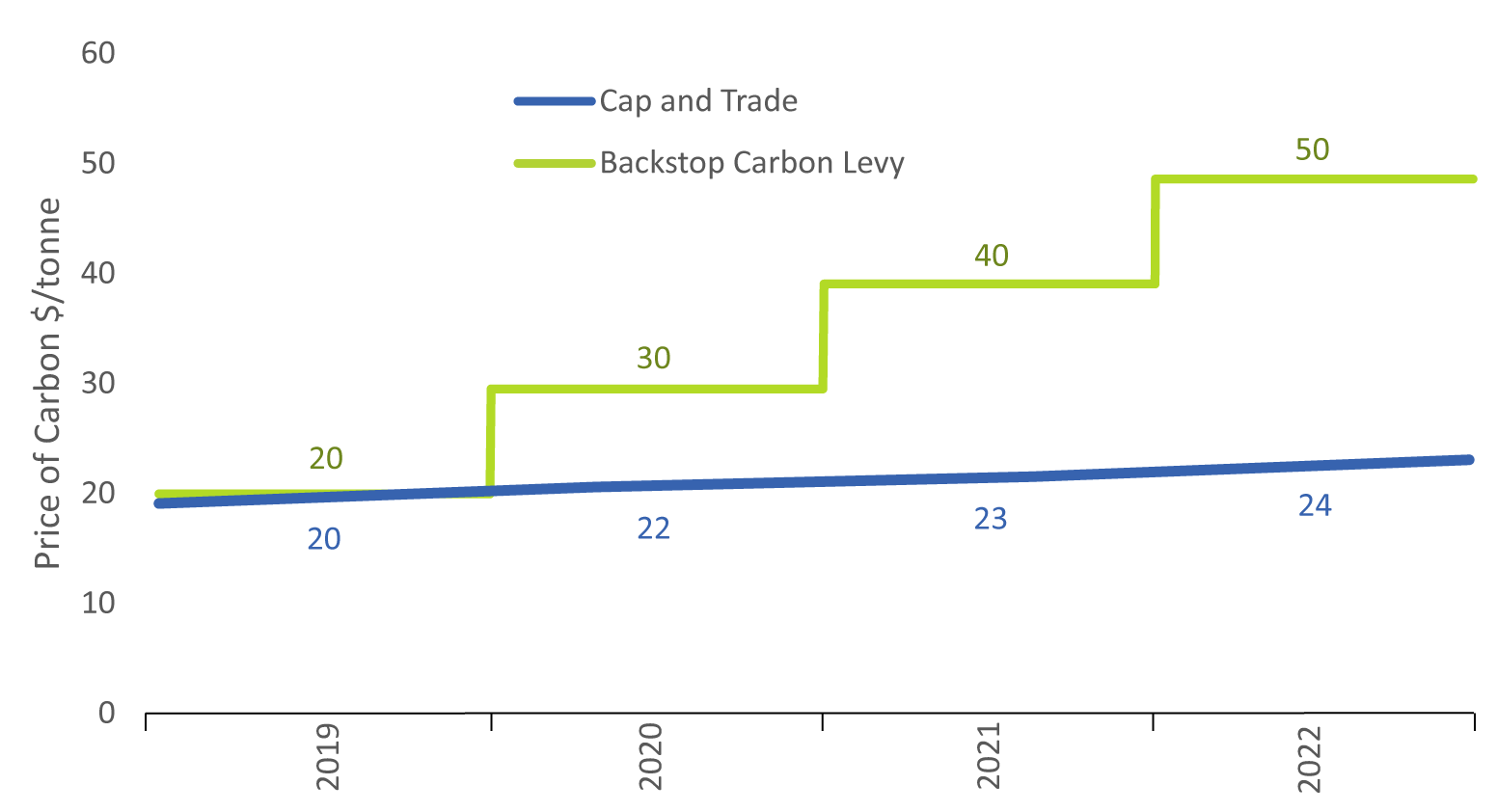

. With a cap you get the inverse. The carbon tax on fuel set a minimum price of 20 dollars per tonne of CO2 in 2019 rising my 10 dollars every year to 50 dollars in 2022 where it will. You can do the same to.

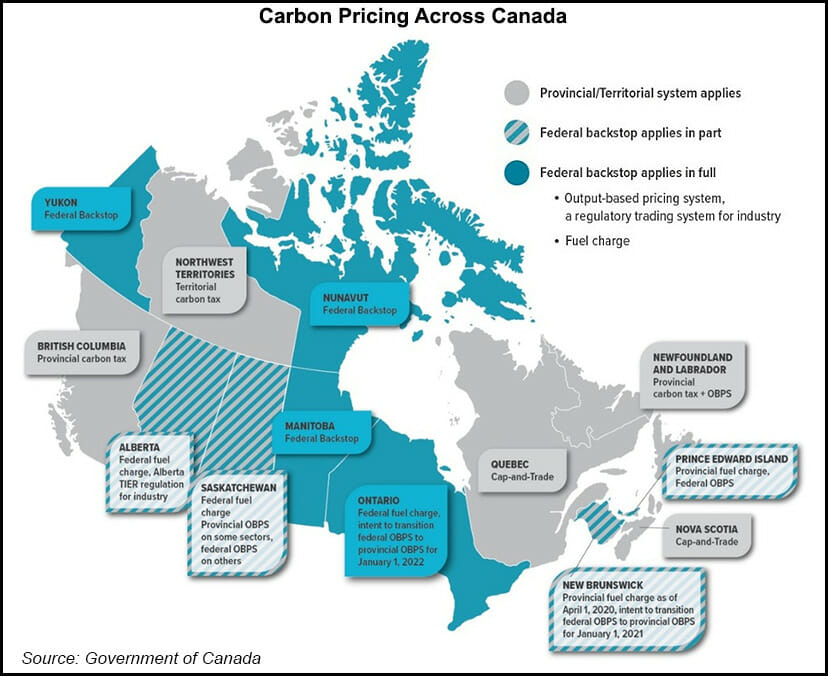

Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario. Provincial carbon tax and OBPS. Canadas Fuel Charge.

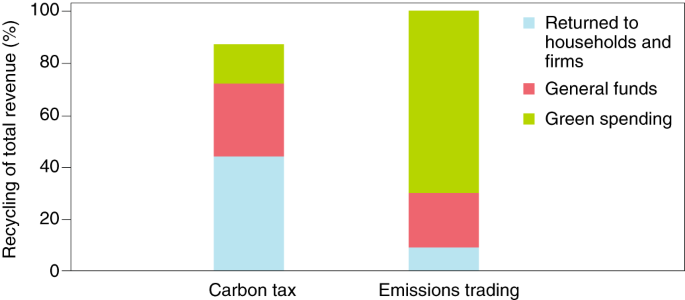

Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy. You can tweak a tax to shift the balance. Carbon pricings costs and benefits to.

But based on the previous analysis for Canada the method that can impact carbon dioxide emissions the most is the carbon tax system. With a tax you get certainty about prices but uncertainty about emission reductions. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism.

A proper carbon tax will deter fossil fuels and. Provincial fuel charge federal OBPS. A Carbon Tax vs Cap-and-Trade.

You can tweak a tax to shift the balance. You can do the same to. Theory and practice Robert N.

On the other hand political economy forces strongly point to less. April 9 2007 413 pm ET. By Brian Schimmoller Contributing Editor.

However some differences exist. With a tax you get certainty about prices but uncertainty about emission reductions. Carbon taxes vs.

It provides more certainty about the amount of emissions re See more. With a cap you get the inverse. Carbon Tax vs.

The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the. Cap-and-trade has one key environmental advantage over a carbon tax. This was partly due to lower production volume overall but the.

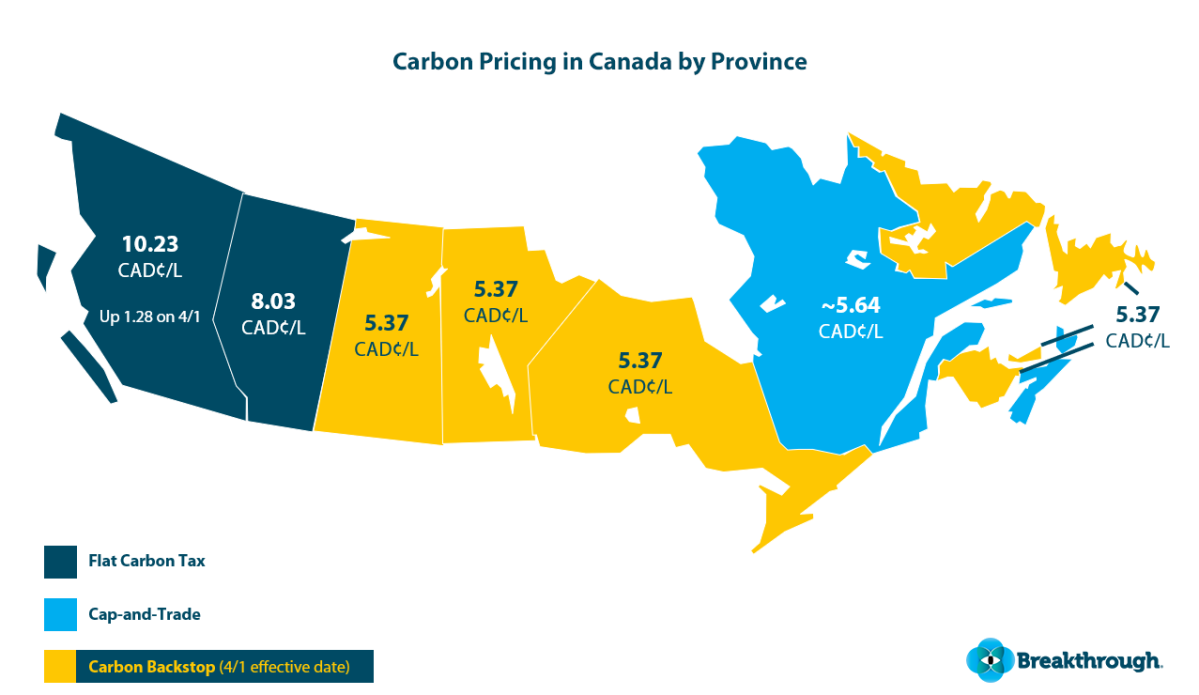

Quebec and Nova Scotia use cap-and-trade systems and Newfoundland and Labrador will raise its price to 50 a tonne later in 2022. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas.

Future energy historians will likely point to November 7 2006.

Understanding Canadian Carbon Pricing Carbon Tax Cap And Trade Carbon Offsets Online Course Green Economy Law Professional Corporation

Difference Between Carbon Tax And Cap And Trade Difference Between

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Difference Between Carbon Tax And Cap And Trade Difference Between

Green Supply Chain News Summarizing Cap And Trade Versus Carbon Taxes To Deal With Co2

What Is Carbon Pricing Canadian Canola Growers Association

Ontario Vs Canada Ontario Challenges The Federal Carbon Tax In Court A Threat To Manufacturing And Jobs They Say Edi Weekly Engineered Design Insider

The Tax That Could Save The World Chicago Booth Review

Where Carbon Is Taxed Overview

Carbon Tax Or Cap And Trade David Suzuki Foundation

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax And Cap And Trade Youtube

Understanding Canadian Carbon Pricing Carbon Tax Cap And Trade Carbon Offsets Online Course Green Economy Law Professional Corporation

40 Countries Are Making Polluters Pay For Carbon Pollution Guess Who S Not Vox

Clarifying The Carbon Tax In The Case Of Canada Ualberta Sustain Su Sustainability Blog

Carbon Tax Canada Transportation Cost Impacts On April 1 Breakthrough Strategic Transportation Solution Provider